Payments Exempted From EPF Contribution. A If the employee has rendered a continuous service of 5 years or more.

However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope.

. The payments below are not considered wages by the EPF and are not subject to EPF deduction. This income of Employee comes under 80C section of Income-tax act. Where an establishment is granted exemption under Section 17 2 of the Act for an employee or a class of employees.

The authority under the Act held that the allowances had to be taken into account as basic wage for deduction. 2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 7 The PF authorities issued a circular in November 2012 which inter alia indicated that the term any other allowance of a similar nature which is to be excluded for PF computation refers only to an. The Employees Provident Funds and Miscellaneous Provisions Act 1952 EPF Act defines basic wages to include any other allowance similar to dearness allowance house rent allowance etc payable.

And annual payout will exempted from ESI Like Diwali bonus Attendance bonus if LTA paid 2 yearly etc Drawing more than Rs. Records pertaining to the claim for official duties and the exempted amount must be kept for a period of seven years for audit purpose. Not all allowances exempt from PF.

Hoping for your favorable responses. Petrol allowance travelling allowance or toll payment or any of its combination for official duties. Any travelling allowance or the value of any travelling concession.

If the accumulated balance includes amount transferred from other recognised provident fund maintained by previous employer then the period for which the employee rendered service to. Courts will consider factors such as whether the allowances are a fixed sum payable to employees on. Allowance except travelling allowance is included in the definition of wages under the EPF Act.

Gratuity payment to employee payable at the end of a service period or upon voluntary resignation Gifts includes Cash Payments for holidays like Hari Raya Christmas etc. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them. Employee Contract Of Service Or Apprenticeship.

16th April 2011 From India Madras. For the previous financial year 2020-2021 the interest rate is 85 In the fiscal year 2019-2020 the interest was 865. 15001- are exempt from deduction of ESI.

Hello Everyone As we all are aware that SC has amended a New Guideline that EPF Deductions will be done on Gross Salary excepted HRA. Hence this part of the income is exempted from tax. An employer is defined as a person s with whom an.

Gratuity payment given for excellent service Retirement benefits. These are the three main elements which determine the obligation to contribute to EPF. In this regards I would like to know which other Salary Heads are exempted from EPF Deductions.

The appellant was not deducting Provident Fund contribution on house rent allowance special allowance management allowance and conveyance allowance by excluding it from basic wage. 2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 14 Reliance on earlier decisions Supreme Court Ruling Decision Issue Held Bridge and Roof SC Whether production bonus is to be included as wages for the purpose of computation of PF The basis for exclusion of certain specified components seems to be all that is not earned in all. Employee Contract of Service or Apprenticeship.

Payments Exempted From EPF Contribution. So that I can prepare Salary Structure accordingly. Service charges tips etc Overtime payments.

Civil Appeal Nos. Accumulated balance paid from a recognised provident fund will be exempt from tax in following cases. You need to register with the EPF if you fulfill the following elements.

Payments which are not liable for EPF contribution are-. The benefits shall not be less favorable t benefits under the Act. All allowances are includible for ESI purpose.

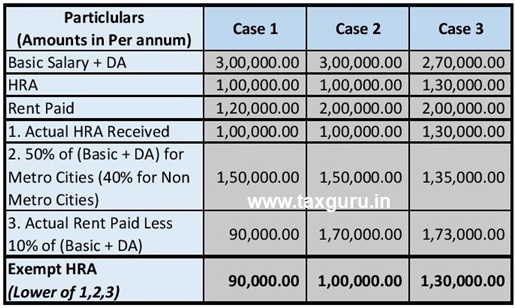

The Central Provident Fund Commissioner has in a circular issued on November 30 clarified the definition of basic wages based on which provident fund is calculated for workers. It has sought to clarify the definition of basic wages based on which. If the amount received exceeds RM6000 a year the employee can make a further deduction in respect of the amount spent for official duties.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. The flexibility exercised by employers and the provident fund authorities in the definition of basic wages has finally caught the attention of the Employees Provident Fund Organisation EPFO. The circular addresses a rampant practice of splitting basic wages to.

This rate always remains higher than PPF or any fixed-income funds. Retrenchment lay-off or termination benefits. Tax exemption on EPF Withdrawal For the below cases there is no TDS Tax deduction at source.

Employee or the class employees shall continue to get benefits in the nature of provident fund gratuity or old age pension. The payments below are not considered wages by the EPF and are not subject to EPF deduction. Workers pay 12 of their basic wages and employers are obliged to pay a matching contribution.

Any other remuneration or payment as may be exempted by the Minister. However circular does not clarify which these allowances are. As regards ESI coverage there is no exclusion for nomenclature.

Special Allowances In India Under Income Tax Return Itr Taxhelpdesk

All About Allowances Income Tax Exemption Ca Rajput Jain

Understand Salary Breakup In India Importance Structure And Calculation Asanify

Which Allowance Is Exempt From Salary Quora

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Exempted Allowances To Salaried Persons Simple Tax India

Post Budget Tax Math Should You Shift From Epf To Nps Now Mint

Know Salary Segments That Can Reduce Employees Tax Liabilities

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

How To Add Conveyance Allowance As A Deduction In Itr 1 While E Filing Quora

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

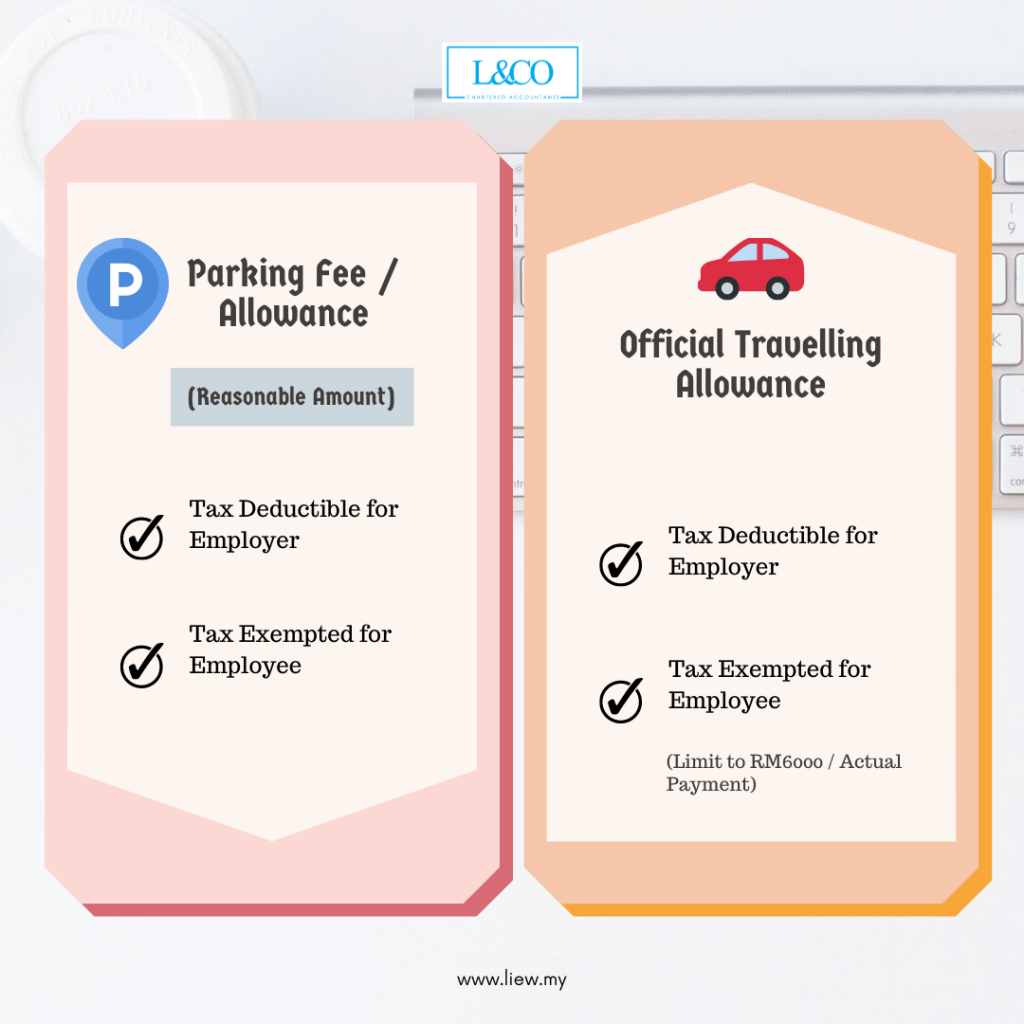

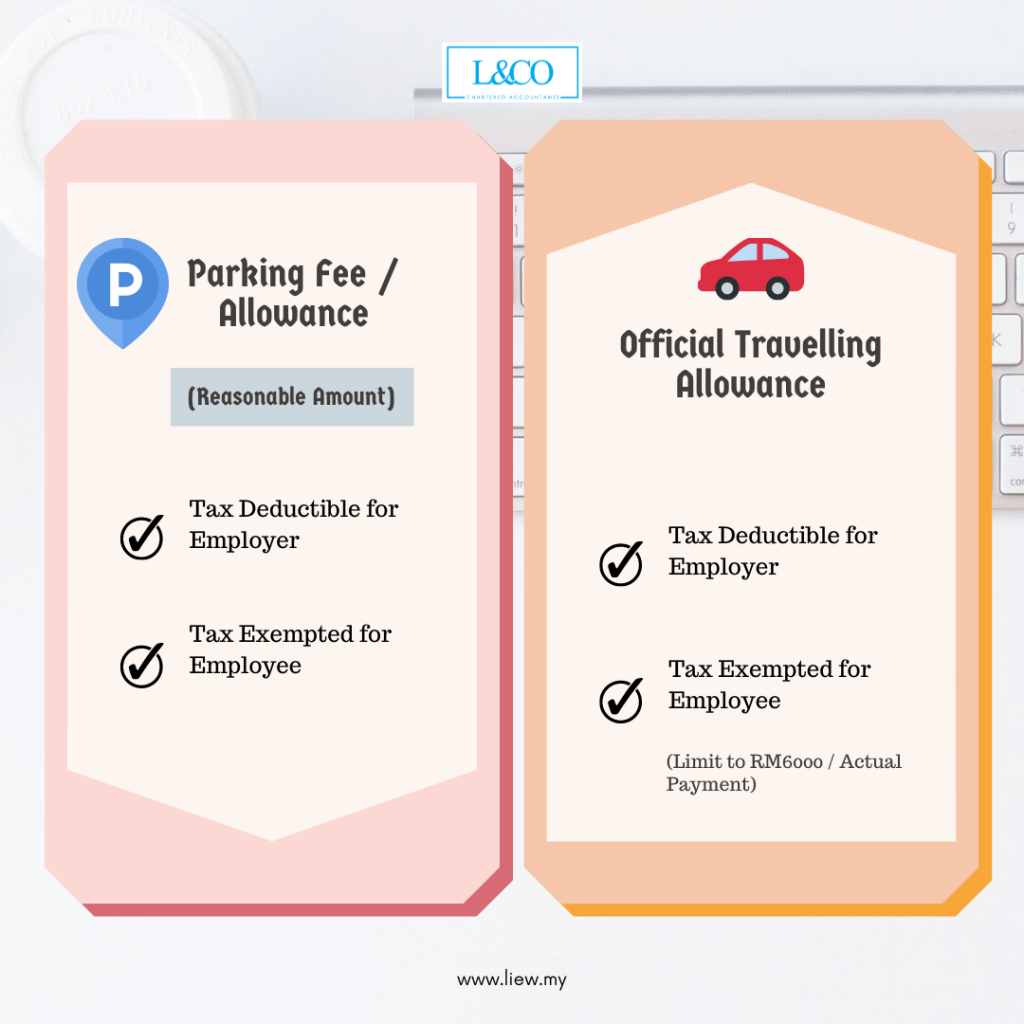

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co